Picklebet will benefit from $15 million of fresh growth capital after a Series A round of financing led by industry specialists Discerning Capital. Drive by DraftKings and Manifest Investment Partners took part in the round of financing too, while betting and media investor Jeff Sagansky was also involved.

Innovative In-House Betting Product and Engaging Media Content

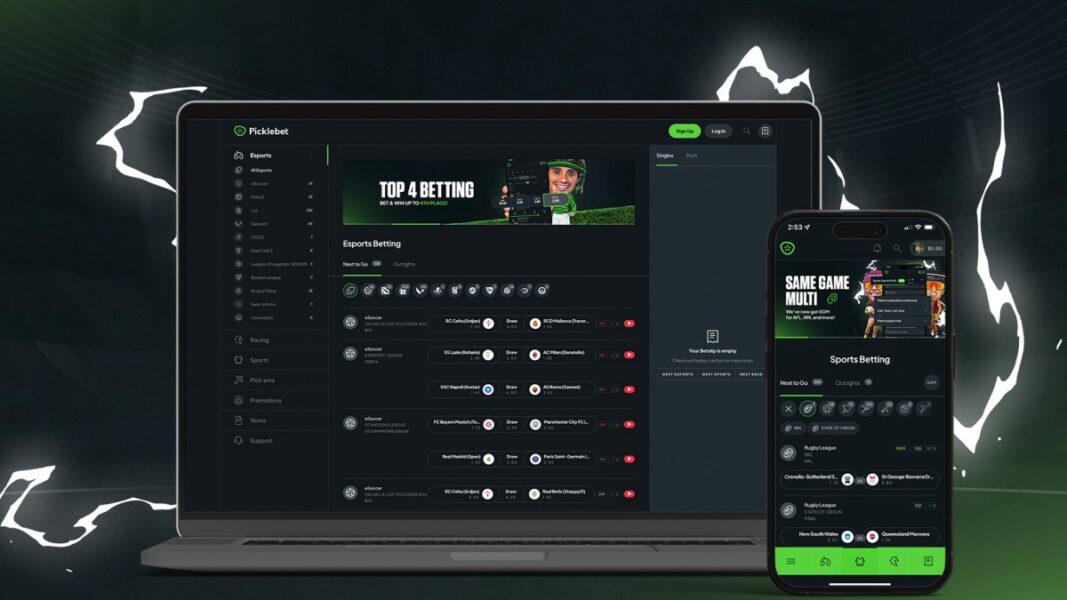

Established in 2020, Picklebet is an innovative racing and sports betting operator that originally started as an Esports-oriented wagering provider. With an impressive year-on-year increase of 494% in Net Gaming Revenue, Picklebet has been turning heads in Australia in the past 12 months and is one of the fastest-growing Australian bookmakers.

Picklebet CEO Nick Heaney was happy that the investment validated their “innovative in-house betting product” and the bookmaker’s “organic media strategy.” Heaney said they were targeting the “next generation of betting customers” and were going to use the funds raised to “accelerate customer acquisition in Australia,” as well as continue to innovate their in-house betting platform and media options.

The Picklebet chief also signalled that the company would now start thinking about expanding internationally. The sports betting platform which is licensed to operate in Australia, is planning to start targeting international markets in 2024.

Acquiring Customers at a Low Cost with Pickle Studios

The betting company also boasts a media division called Pickle Studios, which is growing rapidly too. Pickle Studios is focused on creating short and humorous sports content. It allows Picklebet to boost brand awareness efficiently and funnels customers to the sports betting platform at a minimal cost of acquisition. Pickle Studios has managed to surpass 60 million impressions this year on social media platforms, such as Instagram, TikTok, and YouTube.

Heaney was delighted that the investors that provided the financing were Discerning Capital and not someone else. The Picklebet chief said that Discerning Capital was “the ideal strategic partner” to support the betting operator as it scaled the next growth phase and continued developing its in-house betting product. He added that they would use Discerning Capital’s “insights and expertise” to “reimagine betting and entertainment for the next generation.”

The Best Investment in the Betting Industry

Davis Catlin, Managing Partner at Discerning Capital, singled out Picklebet as one of the most highly compelling opportunities for investment in the betting industry, adding they had the utmost confidence their investment would be successful.

Catlin said the Nevada-based investment firm analyzed various sportsbook deals and felt Picklebet’s unique blend of in-house technology and content, combined with the rapid growth and low-cost user acquisition, made the betting company the ideal investment opportunity.